Good morning Hospitalogists,

Turning back to crusty old healthcare for today’s piece after our panel this morning, all eyes were on UnitedHealth Group’s earnings call to keep a pulse on the latest trends. So, this newsletter is all about the big things I noticed from UNH’s earnings report across utilization trends, some bank commentary on Optum’s exposure to utilization from capitated arrangements, and more.

Let’s get after it, and subscribe here to join 20,000 other healthcare executives and professionals getting ahead on the latest healthcare trends.

I’m proud to have this edition of Hospitalogy Sponsored by VANTA

Healthcare compliance got you pulling your hair out? It would for me!

Meet Vanta, your new partner in simplifying healthcare compliance. Trusted by over 5,000 global customers, Vanta automates those pricey, time-consuming preparations for SOC 2, ISO 27001, GDPR, HIPAA, and more.

We’re talking about getting your audit-ready in weeks instead of months, saving you up to 400 hours of work and cutting down compliance costs by up to 85%.

With nearly 200 integrations, Vanta ensures you can securely monitor your essential business tools.

Join the growing Vanta community today. Vanta wants to mitigate risks, prove security, and build trust together. Check out their on-demand demo to learn more.

Executive Summary: UnitedHealth Group Q2 Analysis

Get caught up quick on my past UNH analyses: (2022 Investor Day Analysis) (Q1 2023 Analysis)

Blip on the Radar: UnitedHealth Group’s financial and operating results from Q2 present some near-term headwinds for the behemoth. For that reason, its share performance is flat for the entire year while the S&P is up nearly 20% despite a recent surge after its mid-summer utilization blip.

Insurance Results = Business as Usual: Commercial growth is strong, MA growth is strong, and Medicaid redeterminations have had nominal impact so far.

Margin Pressure in Q2 as Optum sets up for Long-Term Growth: Higher utilization and more complex patient acquisitions resulted in short-term margin pressure for Optum, but management raved about long-term potential once these complex patient cohorts mature.

Behavioral Health, Orthopedics, and Cardiology Lead Utilization Trends: UNH saw an unwinding of deferred care in its MA population in outpatient orthopedic and cardiology volumes and broad-based adoption of behavioral health across its member population. In both segments United expects utilization to stay high for the foreseeable future.

United Looking at AI for Expense Leverage: Use cases for UnitedHealth include medical appeal letters, provider search optimization, improving payment integrity models, and detection of fraud, waste, and abuse.

Financial Highlights and the Insurance Segment Chugs Along

It really was business as usual for UnitedHealthcare, the insurance segment of the healthcare giant. UNH noted strong growth in its commercial segment, consistent with commentary on its Q1 call, and continued growth in MA as the main driver of growth for the organization in 2023 between InsurCo and Optum.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Big Utilization in Behavioral, Ortho, and Cardiology leads to Optum Health Headwinds

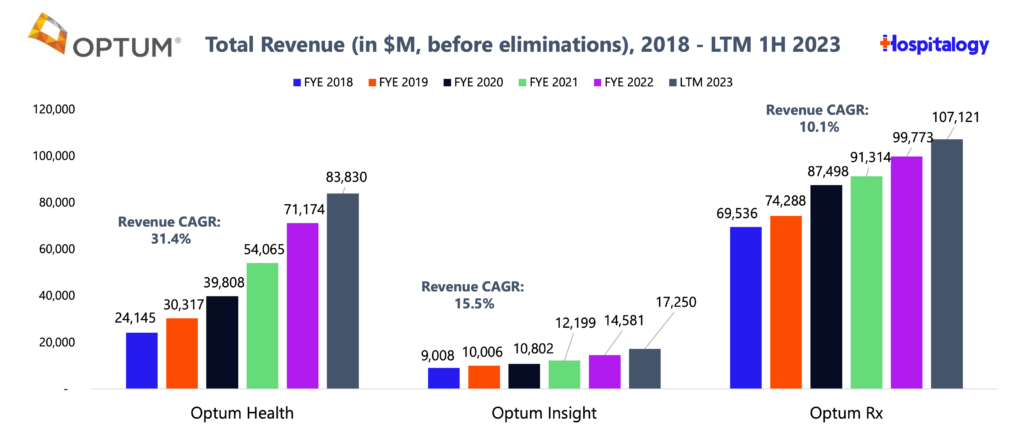

The big component of UnitedHealth’s earnings that analysts and bank notes honed in on, however, was the apparent underperformance of Optum’s Health (services) segment. As you can see in the earlier graphic, Optum’s operating margin compressed, which management attributed to acquiring more complex patients but also the aforementioned utilization spike in patient volumes.

UnitedHealth Group expects utilization to persist at these levels, and for good reason. For instance, it’s now extremely socially acceptable and the norm to seek therapy services. That’s an amazing thing for patients. But as a result, demand for mental health services is piling up on payors to the point where it may prove uncontrollable for some, and it’ll continue to be a growing expense on the MLR.

Secondly, senior utilization trends in ortho and cardiology goes without saying. This dynamic is a secular trend in healthcare as seniors age into Medicare. When I was at Pinehurst, the group I was with included several older gentlemen who had had several knees, hips, and shoulders replaced. (Side note – that reminds me to stretch and lift some weights – ha!)

Here’s the potential concern for Optum, though. Heightened utilization in MA is a headwind for Optum’s Health services division, which, since it participates in full risk (capitation) arrangements, it holds exposure to unexpected surges in services demand (e.g., the ‘downside’ of the whole upside/downside risk equation). It’s a dynamic that a few analysts mentioned in bank notes and one that I’ll share in more detail on my Sunday e-mail with the Boardroom.

Management spend several questions and a bulk of the Q&A on these dynamics, with CEO Andrew Witty even going so far as to say that he’d rather take a short term hit to margin in Q2 to set up massive success down the line in 2024, 2025, and 2026 as complex population cohorts mature in their value-based care arrangements. Of course, Optum is paving the path to risk and holds about 4 million at-risk members across all payors. At the end of the day, the heightened utilization dynamic is one to keep on your radar for UNH.

Other Interesting Tidbits

- OptumRx is now offering multiple Humira biosimilars, expected to net ‘double digit’ savings for patients.

- UNH in general benefits from a higher interest rate environment, as it can simply deposit cash reserves into an interest bearing account to print fat stacks. This dynamic should play out similarly in all managed care organizations.

- No mention of GLP-1 utilization on this call; expect this to be the same as Q1 in which they’re approved for the narrow use case of diabetics

- There is existential risk for UNH which includes upcoming potential PBM legislation (the revolving door of health policy, but still a consideration), potential MA legislation on the horizon related to required data disclosure for vertically integrated ‘payvidor’ MA plans, and future vertical integration guidelines / antitrust scrutiny by the FTC. Still, if the FTC can’t stop Microsoft from acquiring a gaming studio, I’m very skeptical on its ability to have teeth in healthcare.

- As a reminder, recent UNH M&A includes LHC Group, Amedisys, Change Healthcare, Refresh Mental Health, and a slew of physician groups. Areas of healthcare services buildout for UNH includes home health, behavioral health, ambulatory care (SCA), and primary care.

Key Q&A Quotes

Optum Health commentary:

- And then the third area [of Optum Health performance] is a kind of a good news story, but with short-term implications. So that’s really the growth of the membership that’s coming this year. As you know, we’ve grown very strongly this year, actually a little ahead of our expectations. We’ve also brought in a very significant number of complex patients. As we invest in helping those folks manage their care better, that puts a little pressure on the margin in the short run. But that’s really laying super strong foundation stones, not just for as we move through the year but into ’24, ’25, ’26. So those 3 elements, the senior trend piece, the behavioral piece and then the effect of the strong growth is really what explains what goes on.

- And within that, very much a complex care patient, which, as I’m going to repeat again, is an extremely positive element of our growth going forward. That’s going to be an extraordinarily important foundation stone for the future of the company. We’re going to continue to lean into that growth, first and foremost. We do expect to see margins continue to strengthen, particularly as you roll through into ’24. You’re absolutely right. We believe we’ve caught this in our pricing for next year.

- …if I had the choice on a slightly suppressed margin in Q2 or the very significant growth that we’ve taken in, I’ll take the growth all day long. And I’ll take that growth because it’s going to underpin years of growth going forward. (Side note – Andrew Witty getting feisty)

On utilization:

- To illustrate, in the second quarter, outpatient care activity among seniors was a few hundred basis points above our expectations. As we’ve highlighted, specific orthopedic and cardiac procedures had increased far above that level of variation. And as we developed and filed our 2024 Medicare Advantage offerings, we assume that these levels of heightened care activity will persist throughout next year. Overall care activity among our Medicaid and commercial populations is consistent with our expectations.

- …when you look at the concentration of what we’re seeing in terms of the outpatients, the orthopedics, in particular, those sorts of areas, it looks very much more like a kind of deferment of care…We’ve seen a shift in the fraction of people who, once they have been essentially recommended for surgery, actually go through and complete the procedure. Arguably, what might drive that change is, one, more supply. So actually, it’s more possible to go get it done; but two, maybe a little less reticent from an individual to go into a facility in a post-COVID environment versus a COVID environment. That feels like the thing that’s shifted.

On behavioral health trends specifically:

- In terms of behavioral, what we’ve noticed in behavioral is an increase in the number of people accessing care. Andrew had this in his comments, but a very, very significant increase, even just since a year ago in terms of the number of people that are looking to access care. It’s a great thing. We are planning on that continuing. We don’t see why that trend slows down. So we’re designing our benefits for that to continue.

- …we’re seeing across the board increasing utilization. But what’s encouraging from a public health perspective is it isn’t strictly young people. It’s across the board. We’re seeing 30-, 40-, 50-year-olds accessing behavioral health care for needed care for conditions like anxiety, depression, substance use disorder.

On artificial intelligence use cases and cost savings on the G&A side:

- we’ve really been applying a lot of artificial intelligence, machine learning and natural language processing. Long term, we think there’s great hope for those. And some of the short-term things that we’re working on in those areas, like using generative AI to help more efficiently write medical appeal letters, things like optimizing our provider search and all of our digital properties with natural language processing and AI, doing a lot of work, improving our payment integrity models, using AI to detect waste, fraud and abuse.

- …And then a lot in the G&A world to answer basic questions in our call centers, like leveraging our benefit bots to reduce the number of calls and the labor associated with that, for simple questions like is XYZ disease covered or have I met my deductible. From long range perspective, however, I’m really optimistic about our significant data sets.

On MA pricing and risk adjustment dynamics:

- The biggest item though shaping this year has been around the risk model changes…anything we’ve learned recently into our Medicare Advantage bids is extremely important in each and every year especially given how we see both key revenue and medical elements firm up inside of Q2, being able to incorporate the latest thinking that we have in our bid filings is really, really important. And because of that, we’ve designed a bid process that is very nimble and able to accommodate late changes.

- This year, out of respect for a developing trend, we made the assumption that some of these early indications that we are seeing in the outpatient [setting] have talked about would remain durable. And as we sit here today, as John has talked about, these assumptions have validated and they’ve also stabilized. And we feel confident that we’ve made the appropriate accommodations inside of our 2024 bids for all of this.

Join A.TEAM’s webinar about Artificial Intelligence in Healthcare

The role of AI in healthcare is just beginning, and there’s lots of chatter about where the real use cases lie. A.Team has put together some national experts to discuss the exciting world of Generative AI and where things sit today.

Join their webinar on July 27th for an eye-opening conversation: Demystifying AI in Healthcare.

It’s going to be a deep dive into the exciting world of Generative AI. The speakers? None other than some of the best minds in the field. We’ve got Mida Pezeshkian, founder of STEMA_cg, Ohad Zadok, a trailblazing healthtech CTO, and Ed Kopetsky, Stanford Children’s Hospital’s former CIO.

Together, they’ll help us explore how we can turn daunting challenges into opportunities. It’s all about confidently innovating in a field that’s traditionally risk-averse.

So, let’s break down those barriers and join a conversation that could change the healthcare game for clinicians and patients. Hope to see you there!

Parting Thoughts

From a long-term perspective, the UnitedHealth Group Q2 is a blip on the radar, but the blip itself is notable. We should continue to see heightened behavioral and outpatient utilization that insurers not named BUCA will have to deal with in a pressing manner to manage medical spend. On the services side, these segments should enjoy rapid demand growth and there should be no question why M&A and funding in cardiology, orthopedics, and mental health has skyrocketed.

For UnitedHealth Group, it’s notable that the stock price is flat in a year where the S&P 500 is up 20%. It’s had a heck of a run over the past decade-plus, but at what point do you say “when does the machine start to slow down a bit?” From an operational standpoint, nothing is getting in the way of the incumbent giant. But from a valuation and future growth perspective, you might start to wonder whether that the slowdown in performance is already here.

Final thought: it is absolutely hilarious to me that despite the flat-to-defensive tone of the call and the apparent short-term headwinds, that UNH still managed to up its earnings per share guidance for 2023.

UnitedHealth Group will be healthcare’s first trillion dollar company.